Forex Broker Spreads: Fixed vs. Variable Spreads

If you’re new to Forex trading, one of the first terms you’ll stumble upon is Forex broker spreads. Understanding Forex Broker Spreads is crucial. It’s because they affect your trading costs and, ultimately, your profits.

There are two main types of spreads: Fixed and Variable spreads. But what do they mean? Which one is best for you as a beginner trader?

Let’s explore both to help you make an informed decision.

What Are Forex Broker Spreads?

A “spread” in Forex trading is the difference between:

- The buying price (ask price) and

- The selling price (bid price) of a currency pair.

It’s the cost your broker charges for executing your trade. The spread can be seen as a fee, but it’s not a fixed fee like a commission.

It varies depending on market conditions and the type of spread your broker offers.

For example:

The EUR/USD currency pair has a bid price of 1.1050 and an ask price of 1.1052

So, the spread is 0.0002 or 2 pips.

This small difference may not seem like much. However, over many trades, it can add up. That’s why it’s essential to understand the type of spread your broker offers.

Understanding Fixed Spreads

Fixed Spreads are exactly what they sound like – the difference between the bid and ask price remains constant. And it’s regardless of market conditions.

The spread doesn’t change even when the market is:

- Volatile or

- During significant economic news events.

Pros of Fixed Spreads:

- Consistency: The spread stays the same, so you always know what you’re paying. This makes budgeting for your trading costs easier.

- Lower Risk for Beginners: With fixed spreads, you won’t have any surprises during volatile times. This is particularly useful if you’re just starting and want to avoid unexpected trading costs.

Cons of Fixed Spreads:

- Requotes: In times of high volatility, your broker may not be able to execute your trade at the fixed spread, resulting in requotes.

- Higher Costs in Calm Markets: Fixed spreads are usually slightly higher than variable spreads in calm market conditions.

Example of Fixed Spreads:

Let’s say you trade the EUR/USD pair with a fixed spread of 3 pips.

Whether it’s a calm day or a volatile day, your spread remains at 3 pips.

So, if you buy at 1.1050, you sell at 1.1053. The spread cost would always be 3 pips.

Understanding Variable Spreads

Variable Spreads fluctuate with market conditions. They can be low when the market is calm and widen significantly during high volatility or major news events.

Pros of Variable Spreads:

- Potentially Lower Costs: In stable market conditions, variable spreads are often lower than fixed spreads. This can save you money on trading costs.

- No Requotes: Because spreads adjust with market conditions, there are no requotes. This means your trades are more likely to be executed at the price you see.

Cons of Variable Spreads:

- Unpredictability: Spreads can widen significantly during volatile times, increasing your trading costs unexpectedly.

- Higher Risk During News Events: Variable spreads can spike suddenly during economic announcements, which can result in losses if you are not careful.

Example of Variable Spreads:

Suppose you trade the same EUR/USD pair with a variable spread.

During a calm market, the spread might be just 1 pip.

However, if major economic news is released, the spread could widen to 5 or 6 pips.

If you buy at 1.1050 and the spread is 1 pip, you would sell at 1.1051.

But if the market becomes volatile, and the spread widens to 5 pips, you would sell at 1.1055.

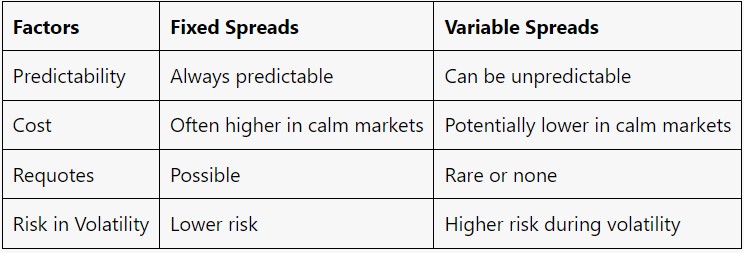

Fixed vs. Variable Spreads: Key Differences

Both fixed and variable spreads have their advantages and drawbacks. The choice between them often depends on your trading style and strategy.

Which Type of Spread Is Best for You?

If you’re a beginner or prefer consistency, fixed spreads might be the way to go. They help you avoid surprises, especially when the market is unstable.

On the other hand, if you are comfortable with some risk and want to benefit from potentially lower costs in calm market conditions, variable spreads could be a better choice.

Your decision should also consider your trading strategy.

If you often trade around major news events, fixed spreads might save you from unexpected costs. Conversely, if you trade during calm periods, variable spreads could offer you lower costs.

Quick Recaps

Understanding Forex Broker Spreads is essential for any trader, especially if you’re just starting. Fixed spreads offer predictability, while variable spreads can provide cost advantages.

The right choice depends on your risk appetite, trading style, and market conditions. Take time to consider what works best for you, and remember, every trader is different.