Retail vs. Institutional Forex Brokers

New to the Forex trading world and wondering where to begin? Then, you might bump into the choice between retail vs. institutional Forex brokers. So, how do they affect your trading experience?

Knowing the difference is crucial for any beginner trader. It can help you make informed decisions and potentially save you money in the long run. Let’s find out more — what makes these brokers different and which might be the right fit for you.

What Are Forex Brokers?

To trade in the Forex market, you need a broker. A Forex broker acts as a bridge between you and the global currency market. They provide trading platforms, tools, and access to make currency trades. Generally, there are two types of brokers: retail vs. institutional Forex brokers.

Retail Forex Brokers

Retail Forex brokers are designed for individual traders, like you and me. These brokers cater to small traders preferring to trade in smaller amounts.

They offer easy-to-use platforms, lower minimum deposits, and access to leverage. Leverage allows you to control a larger position with a smaller amount of money.

Advantages of Retail Brokers:

- Accessibility: Low minimum deposits making it easy for beginners to start trading.

- Leverage: Allows you to amplify your trades.

For example, with a 1:100 leverage, you can control $10,000 with just $100. - User-friendly platforms: Designed for easy navigation and quick trades.

Disadvantages of Retail Brokers:

- Higher spreads and fees: Retail brokers often charge higher spreads or fees to cover their costs.

- Limited tools and resources: Not all retail brokers offer advanced trading tools.

Example Calculation:

Let’s say you deposit $100 with a retail broker offering 1:100 leverage.

This means you can trade up to $10,000 worth of currency.

If the currency pair you are trading moves by 1% in your favor, you would make a profit of $100 ($10,000 x 0.01).

However, if it moves against you, you could lose your entire deposit.

Institutional Forex Brokers

On the other side, institutional Forex brokers cater to large entities, such as banks, hedge funds, and other financial institutions.

These brokers deal in massive trade volumes. They offer more advanced trading platforms, tighter spreads and deeper liquidity.

Advantages of Institutional Brokers:

- Lower costs: Tighter spreads and lower fees due to larger trade volumes.

- Advanced tools and data: Access to full market analysis and sophisticated trading tools.

- Better execution: Due to deeper liquidity pools, trades are executed faster and at better prices.

Disadvantages of Institutional Brokers:

- Higher minimum deposits: Typically require substantial capital to open an account.

- Complex platforms: Not always beginner-friendly due to their complexity.

Example Calculation:

Suppose a hedge fund places a $1,000,000 trade with an institutional broker at a spread of 0.1 pips.

The cost of the trade would be around $10 (1 million x 0.0001).

Compare this to a retail broker, where the same trade might cost $50 or more due to wider spreads.

Key Differences: Retail vs. Institutional Forex Brokers

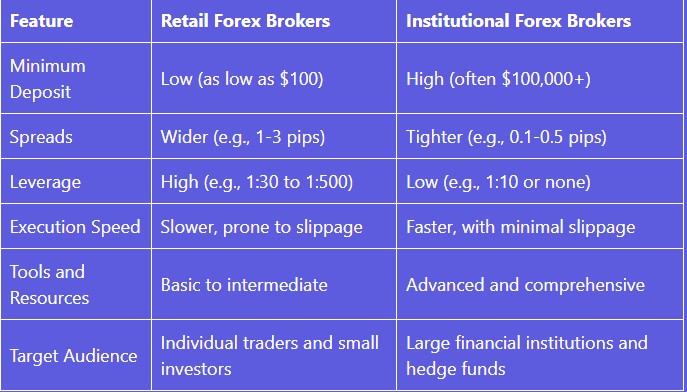

Here’s a table comparing Retail Forex Brokers and Institutional Forex Brokers:

This table provides a clear overview of the key differences between Retail and Institutional Forex Brokers in terms of minimum deposit, spreads, leverage, execution speed, tools and resources, and target audience.

Which Type of Broker is Right for You?

Choosing between retail and institutional Forex brokers depends on your:

- Trading goals,

- Experience, and

- Capital.

If you’re a beginner with a small investment, you should go for a retail broker. It’s because of its lower entry barriers, simpler platforms, and higher leverage.

But, if you have substantial capital and need advanced tools and tight spreads, an institutional broker may be a better fit. The right choice needs to align with your trading style and goals.

Happy Trading!